FIs aren't riding the AI hype cycle volatility that's hammering other industries...

|

Reading time: 5 minutes Your Friday FiveEvery Friday we distill 200+ insurance, legal, and market-risk articles into three signals your board may need for its Monday briefing. Three developments caught our attention this week:

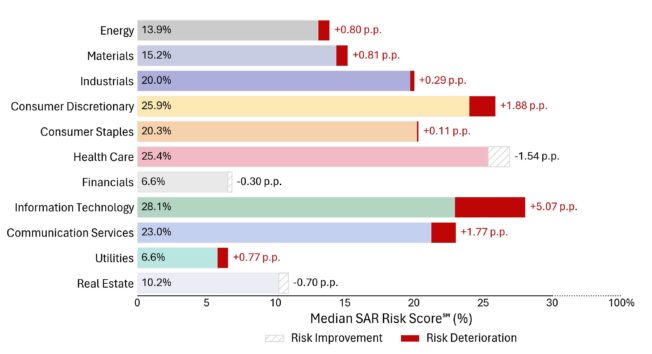

Securities litigation risk just hit $13.7 trillion, and D&O underwriters are paying attention.SummarySecurities litigation risk exposure for U.S. public companies has reached $13.7 trillion in cumulative market capitalization losses linked to high-risk adverse corporate events. That's up nearly $2 trillion since July. Between June 30 and November 30, issuers on the NYSE and NASDAQ faced 806 additional high-risk disclosure events that triggered material stock declines. Despite aggregate U.S. market cap expanding by $10.7 trillion (15.3%) during the same period, the rate of litigation-triggering losses outpaced equity growth by 1.5 percentage points. The market is making money, but the risk exposure got worse. (source) So what?D&O underwriters are taking notice. According to SAR's analysis, companies with higher-than-average frequency of adverse corporate events could face premium increases in 2026. Particularly those with greater market cap losses per disclosure relative to their peer group. As the chart shows, this is basically every other industry with the exception of financial services. The AI capex boom is adding fuel. Shareholders are demanding clarity on returns tied to record AI-related capital expenditures. When those disclosures disappoint, stock drops follow. For board members at financial institutions, this creates a direct line between your disclosure practices and your D&O renewal.

Financial institutions carry the lowest lawsuit risk score in the market at 6.6%. That improved by 0.30 percentage points while tech companies saw their risk spike by 5+ points to 28.1%. Your sector isn't riding the AI hype cycle volatility that's hammering tech D&O pricing. That stability matters at renewal. Make sure your underwriting team knows it. Monday morning action: audit your two-year corporate disclosure record before your underwriter does. Ninety-five percent of firms haven't seen AI ROI, and insurance boards are done waiting.SummaryThe hype cycle was just noise for financial institutions. After years of pilot projects and proof-of-concepts, the insurance industry is entering what one expert calls the "reckoning" phase of AI adoption. Boards are asking the hard question: where's the return? An MIT study puts the stakes in sharp relief. Ninety-five percent of firms across all industries have yet to realize measurable ROI from AI initiatives. The insurance industry may outperform that benchmark, but only if carriers abandon what SIAA's chief data officer Anurag Shah calls "silver bullet" thinking. Transformation narratives don't impress underwriters. Measurable efficiency gains do. The firms showing real traction target operational friction that shows up in the numbers: quote turnaround, claims cycle time, renewal retention. (Source) The LION LensWhat happened — Insurance carriers and brokers continue heavy AI investment, but the conversation has shifted from "what's possible" to "what's the payback" as ROI expectations mature (Insurance Business Magazine). Why it matters — The gap between experimentation and value creation is widening. A related Bain & Company assessment found 78% of P&C insurers are using generative AI in some capacity. But only 4% have scaled it across their organizations. (Source) Practical implications — Efficiency-driven use cases are delivering the clearest returns: faster quote generation, improved renewal rates, reduced claims cycle times, and measurable productivity gains. State Farm, USAA, and Allstate hold 77% of all insurer AI patents. So what?The winners tie deployment to specific operational problems. Shah puts it plainly: "If you improve renewals by even a small percentage, you can show the math very clearly. You know what you spent, and you can see the uplift." That's the new standard. Deloitte's 2025 survey confirms executives now expect AI initiatives to take two to four years to deliver satisfactory returns. Longer than typical IT projects. For middle-market insurers, this patience gap creates both risk and opportunity. You can't afford to wait out a four-year payback. But you also can't afford pilots that never scale. The LION POVHere's how we're advising clients:

The carriers scaling AI well share one thing. They stopped asking "what can AI do?" and started asking "what problem can we fix Monday morning?" Want to discuss how AI deployment affects your institution's underwriting risk profile? Contact LION Specialty for a confidential review. After serving hundreds of FIs, this is what Executives actually need from their broker:SummaryMost brokers serve institutions. Fewer serve the executives who lead them. This week's Wednesday Intelligence explored why that distinction matters. Particularly when a regulatory investigation or shareholder action makes your D&O policy suddenly personal. The piece unpacks what financial institution executives actually need from their broker: time back in your day, personal protection that holds up under pressure, and board-ready answers when your directors start asking questions. Coverage that exists on paper differs from coverage that performs when you're the one being named. Read the Wednesday Intelligence → So what?Securities lawsuit risk has climbed to $13.7 trillion. AI disclosure pressure keeps growing. Personal exposure for executives is no longer just a concept. Side A coverage gaps, exhausted limits, and severability failures determine how personal assets get exposed when claims get serious. These aren't broker talking points. They're the mechanics of real litigation. If you haven't examined how your D&O program would actually perform under stress, now is the time. Read the full piece and see how your current program measures up. The Bottom LineThe pressure on financial institution boards is piling up. Securities lawsuit exposure grows faster than stock values. AI spending faces harder questions from investors ready to sue when updates disappoint. Through it all, your personal D&O protection is only as good as the structure behind it. That's why we created the D&O Contract Vigilance Blueprint. It's a 5-day email course to help you:

>>> Get the D&O Contract Vigilance Blueprint Don't wait until a claim hits to find out your institution is under-protected. Thank you for reading today's edition!Want to share this edition via text, email or social media? Simply copy-and-paste the link below: And if this briefing was forwarded to you, subscribe directly here. Stay Covered, Natasha & Mark Co-Founders and Managing Partners LION Specialty |

LION Specialty

Everything you need to know to navigate the financial institution insurance market in ≈ 5 minutes per week. Delivered on Fridays.

Reading time: 3 minutes Built for Executives When a crisis strikes your financial institution, the board doesn't ask about your coverage. They ask what you're doing about it. You need more than insurance. You need confidence, clarity, and counsel. As a financial institution executive, you carry personal exposure that extends beyond institutional risk. Your D&O coverage, your reputation, and your ability to lead through challenging events depend on having the right partner in place before you...

Reading time: 5 minutes Your Friday Five Every Friday we distill 200+ insurance, legal, and market-risk articles into three signals your board may need for its Monday briefing. Three developments caught our attention this week: OpenAI terminated its analytics vendor after a breach exposed customer data - a reminder that your third-party risk is your first-party problem. President Trump announced and signed a "One Rule" Executive Order seeking to preempt state AI regulations. We break down...

Reading Time: 3 Minutes The LION Lloyd's Program for US Insurance Operations Standard insurance policies aren't written for claims. They're written for arguments. Most FI policies run 150-200 pages of deliberate ambiguity - language designed so lawyers can debate meanings, not so coverage responds clearly. We've reviewed hundreds of these policies over two decades. The pattern is consistent: critical terms buried in endorsements, exclusions that contradict coverage grants, and provisions that...